The health tech market is growing

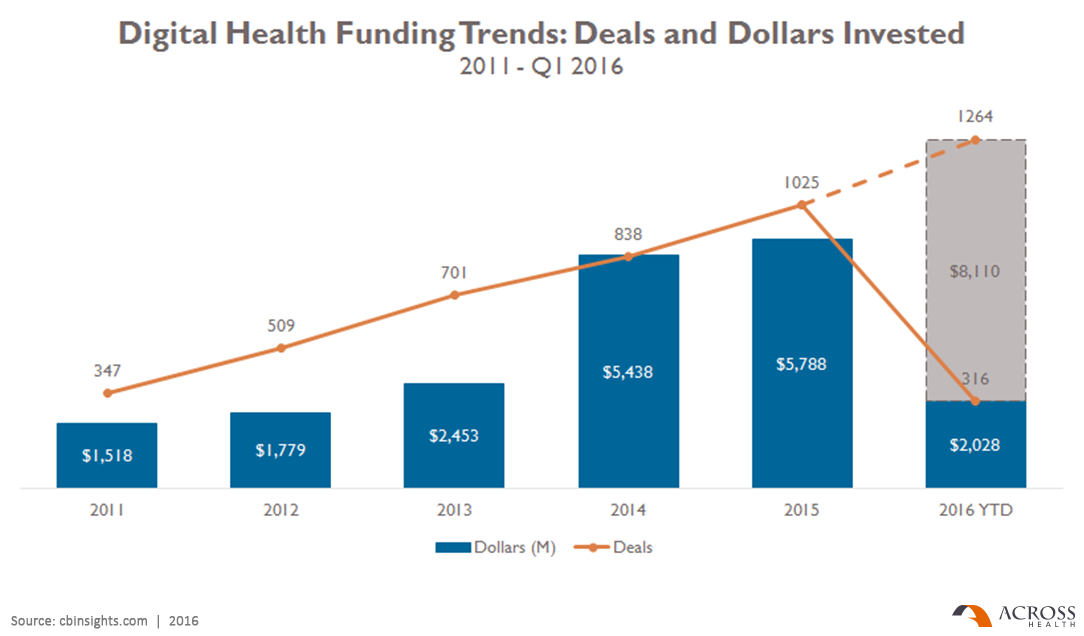

These are very exciting times for digital health, with CB Insights showing the total level of investment at $5.7bn for 2015. Looking ahead, 2016 is set to continue this trend with $8bn of investment expected. Clearly interest and engagement is mounting.

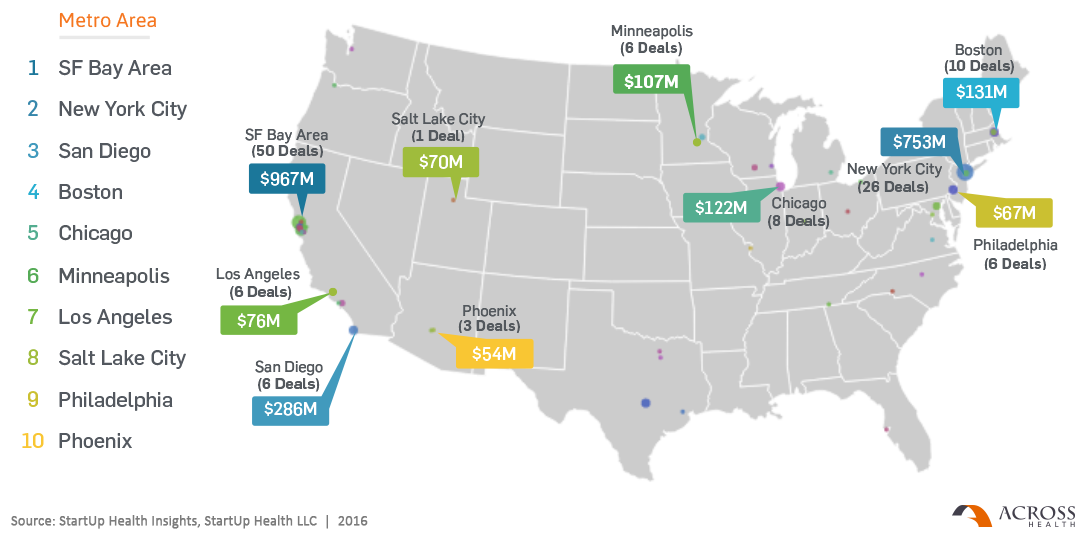

Investment interest is reflected at both ends of the startup spectrum – small and large-scale companies. In terms of geography, the US is the current hotbed of venture capital investment. Indeed, many leading investors such as Andreessen Horowitz, GE Ventures, Startup Health and Rock Health are based on the East and West coast. Many deals are now being conducted out of the New York/Boston area in addition to the established technology hubs of Silicon Valley and San Diego.

The investment chart below shows New York is now the 2nd largest area for investments and #deals.

We are also seeing increased digital health tech focus in Europe (UK, Germany) and the Far East. In particular, China is investing the equivalent of $140 billion in reforming its health and biotech sectors. BGI Shenzen, China’s largest biotech firm, recently acquired the US firm Complete Genomics, making it the world’s leader in gene sequencing and human genomics – despite sequencing health tech being previously centred on West coast. Similarly, India is likely to become a future powerhouse in health tech.

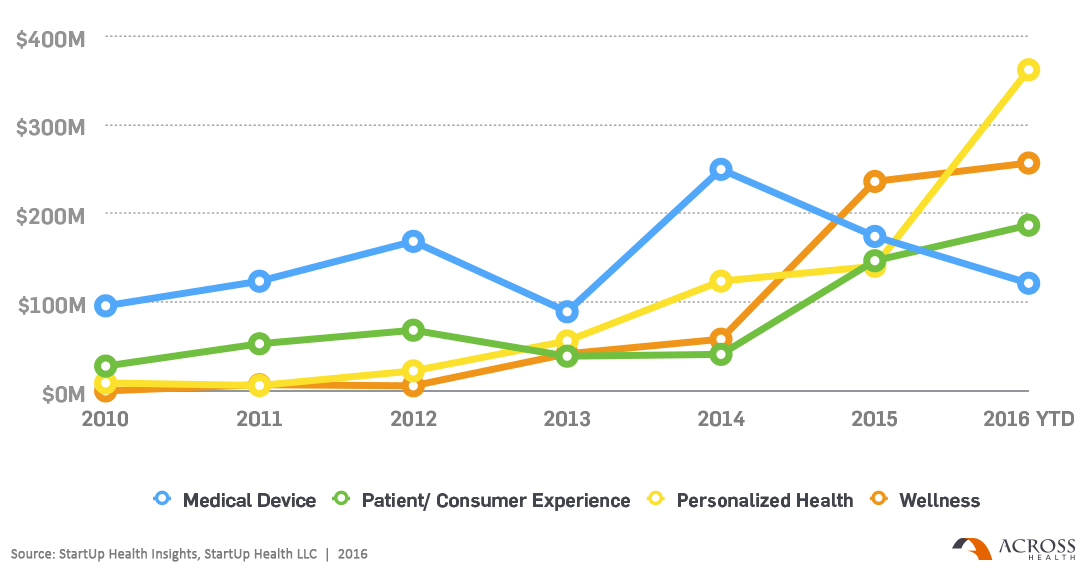

To reinforce the diversity of focus, the Startup Health mid-2016 report chart above shows an explosion in the personalized health space, where companies like Flatiron Health, who organize real-time oncology data to help cancer patients and doctors, have received significant recent funding.

How does pharma deal with “the day after tomorrow (DAT)”?

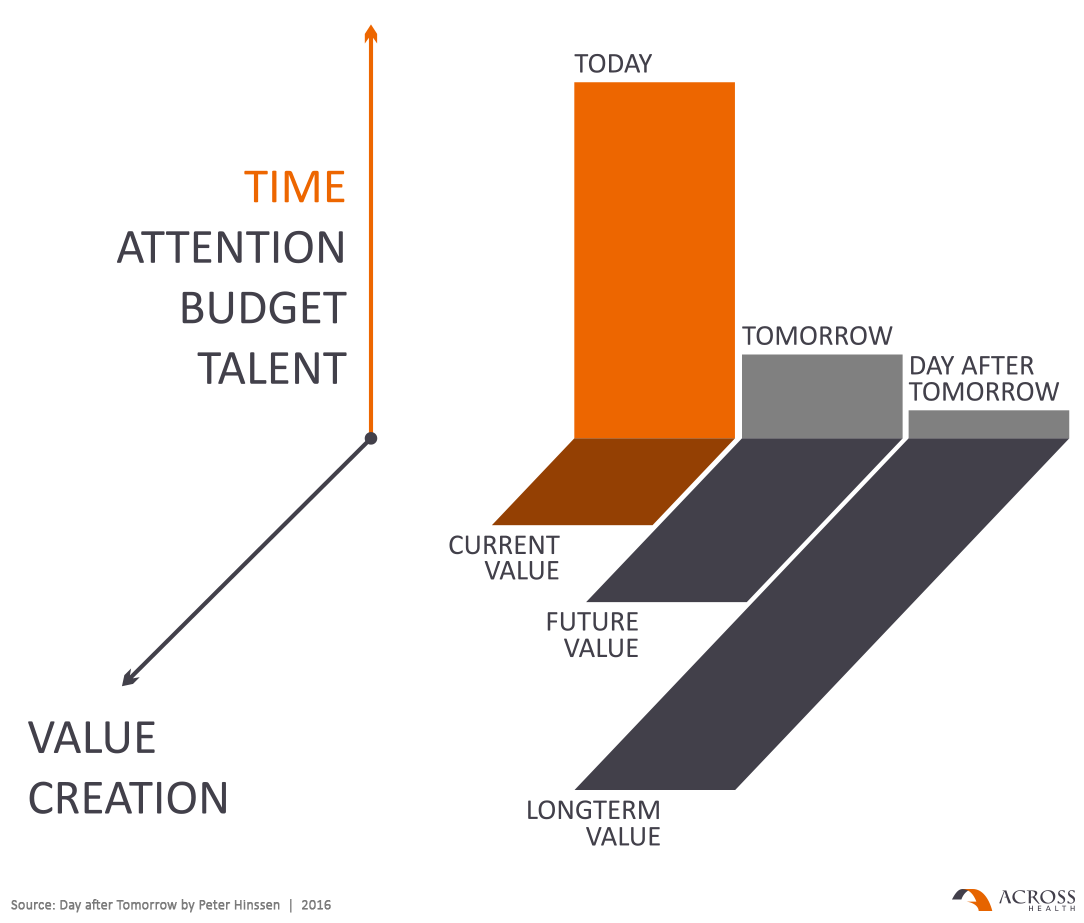

The pharma industry is starting to engage in this fast-moving space and is developing different types of partnerships to prepare for the “day after tomorrow”. Peter Hinssen, the keynote speaker of our upcoming webinar and tour guide for the second Healthcare Disruption Tour, developed the following framework around DAT: businesses spend up to 80-90% of their time on day-to-day operational issues, and 10-20% on the 1-3 year future, but hardly any time on DAT (0-5%), while the future value of the company is most influenced by this area.

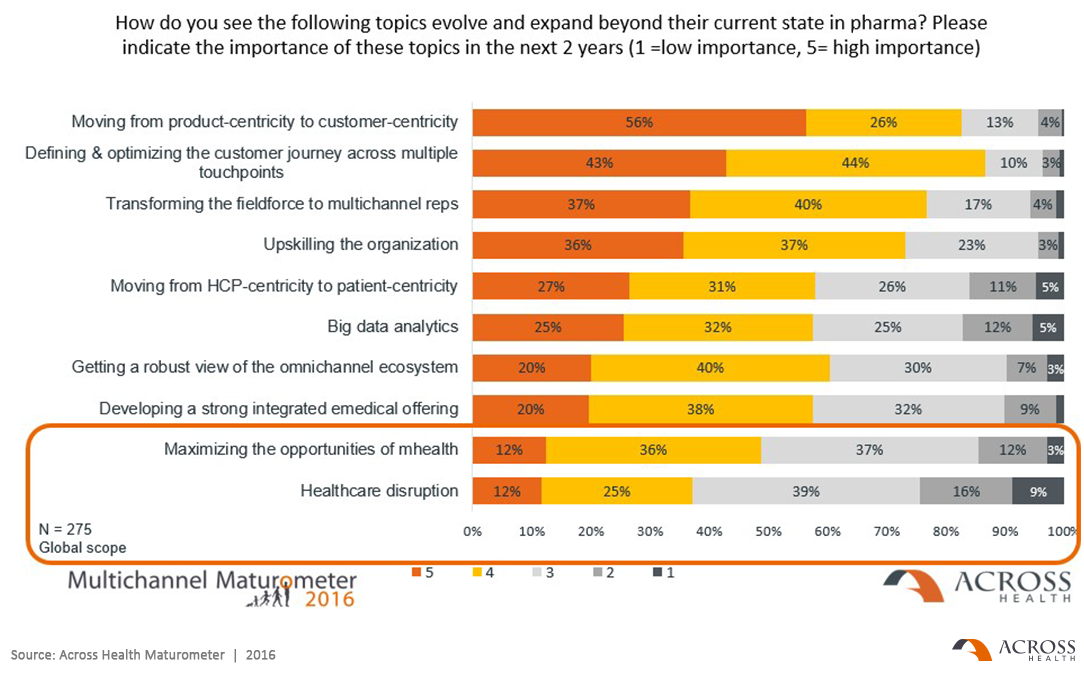

Our 2016 Multichannel Maturometer confirms this DAT-myopia: disruption and mHealth get the lowest level of priority when digital priorities is concerned.

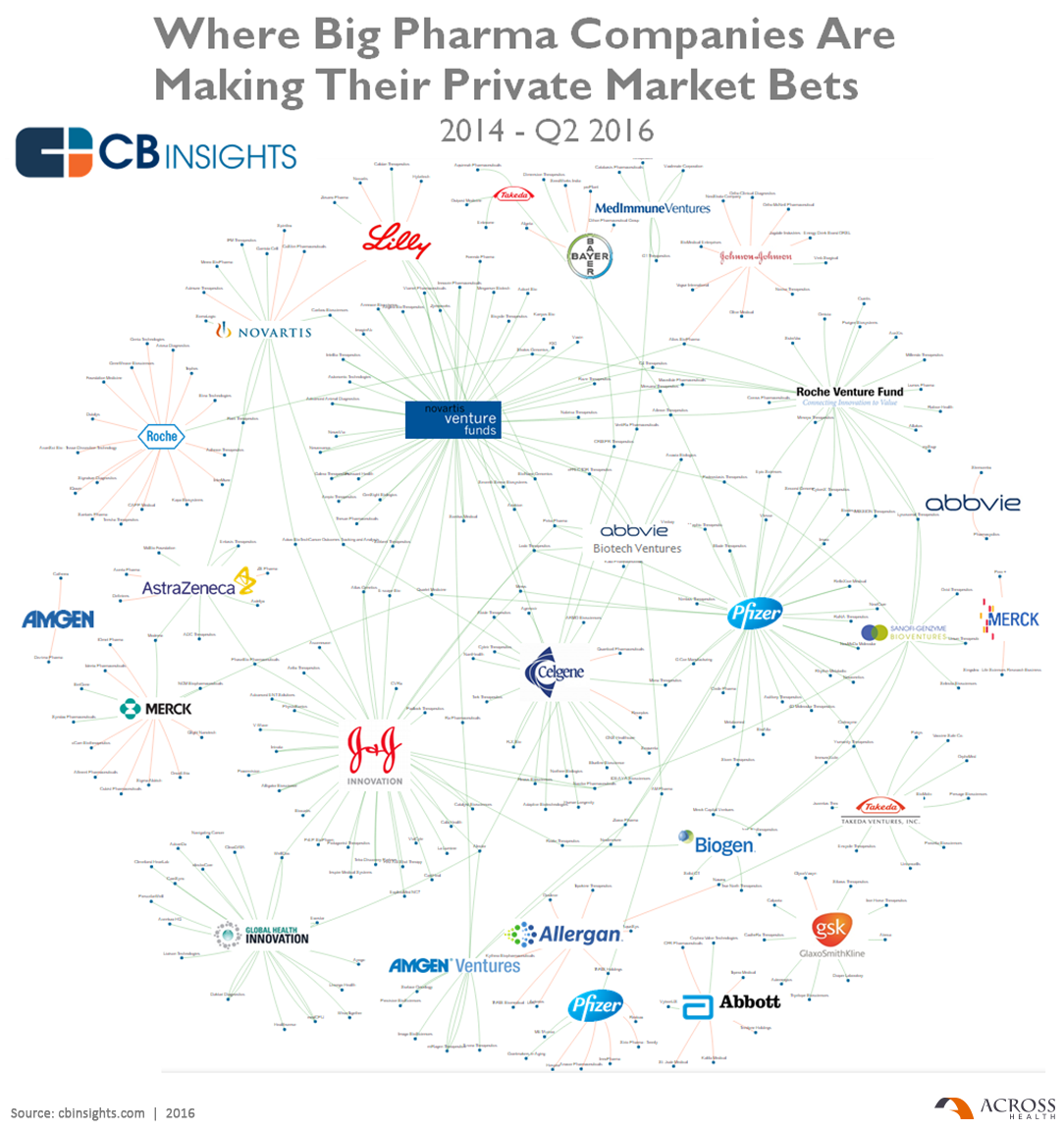

However, progress is being made. The CB Insights chart below shows where Big Pharma has been investing between 2014 to mid-2016. And recent partnerships like GSK & Verily ($715m), Roche & Flatiron ($175m), AstraZeneca & Adherium ($26m), and Merck & WellDoc ($22m) confirm the uptick.