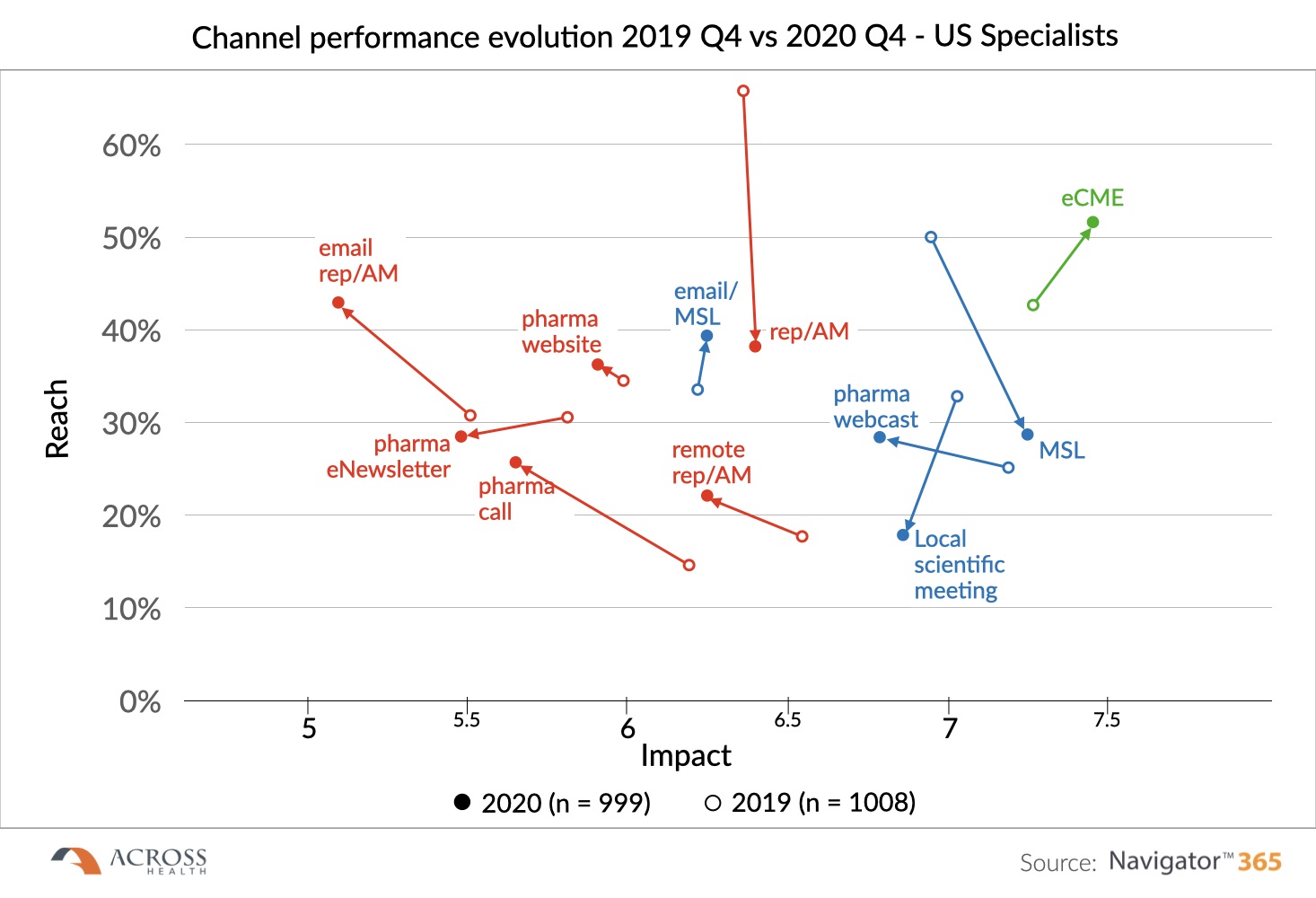

When in March 2020 HCP access came to a grinding halt, biopharma moved to non-personal channels to compensate for the steep drop in traditional engagements. Did this move increase the reach - and impact – of digital pharma channels?

We compared selected owned medical (blue) and promo (red) channels between Q4 2019 and Q4 2020 US data using the Navigator365™ TimeTrends Powertool. All traditional F2F channels (rep, MSL, meetings) unsurprisingly showed a steep drop in reach, but their impact remained on par or even improved (scarcity factor) – except for local meetings (fear factor?).

Most digital field-originated channels went up in reach, but lost impact (the only exception being email MSL). Office-based channels (enewsletter, website, webcast) hardly showed any increase in reach, but went down in impact. What could be behind this? Office-based functions may not have felt it was their responsibility to support the field in keeping up engagement levels – or may have prepared for this, but then got stuck in MLR? A mix of these 2 factors? …

What’s the conclusion: the Next/New/Never Normal may just be around the corner, but biopharma needs to avoid digital fatigue by focusing on creating & executing an HCP-centric omnichannel engagement strategy. As a case in point, the “eCME” evolution (and email MSL) confirm that HCPs ARE interested in quality digital content, so it’s a matter of the baby and the bathwater.

PS in EU5, both reach & impact of non-personal digital channels went up strongly – one may infer from this that here the “novelty” factor played (US traditionally being a much more digital market already). But EU biopharma staff should not mistake the “digital honeymoon” as a sign of a long-lasting marriage…only a truly crossfunctional omnichannel customer-centric engagement strategy & execution will pave the path to success.