Facts for thought

How competitive Cx benchmarking could lead to improved business outcomes

The importance of a holistic KPI framework for demonstrating business impact

Searching for the “ultimate” KPI for HCP customer experience in biopharma

Is pharma underleveraging the digital opportunity for launch products?

Which is more important for good NPS ratings – brand attributes or Cx?

Zero-based customer-centric versus

'copy-paste' budget planning

Dos and don’ts of benchmarking

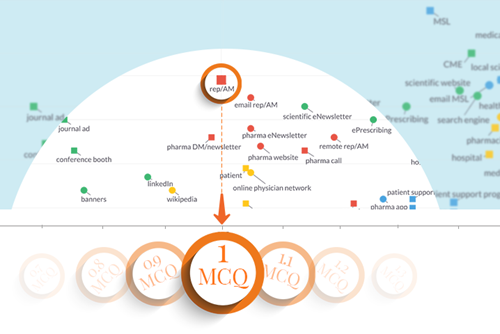

Quantifying your omnichannel campaign plan with MCQ

MCQ – Dos and don'ts

The MCQ (or MultiChannel eQuivalent) is a standard unit of engagement, developed by Across Health as a common measure that enables you to compare the relative impact of different channels. Previously, we introduced the MCQ concept and its important role within our Navigator365™ customer engagement insights research. In this follow-up post, we will offer a quick summary of MCQ-related dos and don’ts, to help ensure you get the most out of this useful measure…

Comparing the impact of customer engagement channels – the role of the MCQ

Launching an effective omnichannel strategy requires the utilisation of multiple channels to reach and engage with your audience. But not all channels are created equal… For example, no one would doubt that a banner view is less impactful than a 30-minute webcast.

When deciding how to allocate precious budget, it would obviously be advantageous to be able to make useful evidence-based comparisons of the relative effectiveness of the various channels on offer.

Key omnichannel trends in biopharma

In 2021, Across Health ran its thirteenth annual Maturometer study. We took the pulse of pharma’s efforts and ambitions in the digital and omnichannel space.

Beware the 'Swan Effect' in your customer data

The ‘Swan Effect’ is one of the most well-known metaphors in business; the bird gliding gracefully on the water… but paddling like crazy beneath. Keeping in mind that ilusion when analysing your customer data can help you to glide gracefully to commercial success.

“Pump up the volume” without customer focus is a dangerous strategy

When in March 2020 HCP access came to a grinding halt, biopharma moved to non-personal channels to compensate for the steep drop in traditional engagements. Did this move increase the reach - and impact – of digital pharma channels?

We looked at channel performance evolution for US specialists between Q4 2019 and Q4 2020. Discover what we found!

Preparing for take-off: a ticket to first class MCM planning

Pharma industry approaches the critical runway of annual brand planning and marketers need to prepare their multichannel marketing (MCM). For a pleasant long-haul journey and a successful landing, it pays to have a clear flight path, a good navigation system, and an agile toolbox that helps you fly safely in and out of the jet stream. Are you ready?

Maturometer 2019: the budget paradox - where do we go from here?

After 3 years of robust growth in digital marketing budgets, 2019 showed a pullback to 2017 levels.

We have a couple of hypotheses to explain this surprising finding.

Benchmarking the multichannel rep and implications for the go-to-market model

When does digital enhance a field force effort – and when during the product life cycle is optimal to be supported? These are key questions for any multichannel approach towards HCPs…. And are also crucial for evaluating the relative merits of business cases for different products, markets and maturity.

The hare and the tortoise of digital transformation in pharma

Chasing after shiny new (digital) objects may help pharma companies appear to be ahead. But that’s not what’s going to lead to sustained results. Instead, a concerted, multi-year effort across all four Gleicher areas will increase the likelihood of a successful digital transformation significantly.

Pharma’s journey towards the multichannel rep

Is hope and desire matching to understanding and reality for the multichannel rep? Beverly Smet outlines the complex questions and wrinkles in the execution of this potentially industry shifting development

The journey towards digital natives: is pharma driving against the traffic?

Education for physicians has been getting more personalised and diverse for many years – and digital-first is the expectation for many born after 1980. Developing multidimensional segmentation models is one of the only ways to offer great experiences to HCPs…

The multichannel rep: slideware or sizzling? Key trends in EU5

The multichannel rep concept has quickly gained fame in pharma – and has the promise of overturning the traditional (rep) engagement model. Pharma has been experimenting on the premise that this frame will profoundly alter the nature of its relationships with customers… but have these experiments paid off?

Food for thought: is pharma feeding HCPs the wrong diet?

Despite it being almost five years since we reached the tipping point of digital native HCPs, many within pharma still don’t have a good grasp of how HCPs prefer to consume information. There’s a clear gap between digital demand and supply...

How to help HCPs swim in an ever faster eMedical education current…

Between 2010 and 2020, the creation of medical knowledge will speed up by a factor of fifteen. Big data, real world evidence, NCEs, new indications, faster clinical trials, combination therapies, new biomarkers and novel diagnostics will go from niche interest to core value proposition. How can pharma help physicians engage with the newest information?

Disrupt or be disrupted, that’s the question for big pharma

The calm is over – and the future for health tech may well now be here. Digital upstarts have started making inroads into “pharmaland”, most visibly in chronic diseases like diabetes and respiratory, and it is high time to adapt. But pharma does not seem to see the urgency...

You can’t buy satisfaction – as Pharma continues to find out

We have recently unveiled the results of the 2017 Multichannel Maturometer study. After five years of slow progress, it appears that we have - finally! – got onto the runway for digital in pharma. However, we also see a continuation of the historic low level of satisfaction with digital and multichannel activities...

Digital maturity: a tale of two countries

Every time I meet with pharma clients, we (almost inevitably) end up discussing digital maturity levels. I very often hear that “Spain has our best digital team – they are really ahead of the pack.” So we went to the data for answers...

Are Pharmaco’s the horse shoe makers of the 21st century?

Henry Ford may not have meant to, but he broke a lot of things – for one, the horse shoe industry. His innovation was so radical that those he ended up putting out of business didn’t even necessarily think of him as a competitor. Is there a lesson here for us today?

Status Quo in Digital Pharma Maturity – A Dangerous Place to Be

With the most recent Maturometer results of 2016 we see overall a replication of the past = status quo of digital maturity in pharma. This is concerning...

Organizing for Digital Health Disruption in the Day after Tomorrow

These are very exciting times for digital health, with CB Insights showing the total level of investment at $5.7bn for 2015. Looking ahead, 2016 is set to continue this trend with $8bn of investment expected. How is pharma dealing with this new future ahead?

Digital maturity: deep divide between senior vs operational staff

Our recent webinar on the 2016 Multichannel Maturometer zoomed in on the 2-speed digital adoption in pharma. Although the industry in general is still in a low-level status quo (low skill set, low budgets, low satisfaction), some leaders are already well ahead of the pack... We decided to dig deeper into real and perceived differences between functions: managers vs directors/VPs. Do we see a similar 2-speed trend there?

Who leads in digital communication and patient-centricity for rheumatologists in EU5?

In Q4 2015, over 400 EU5 rheumatologists were asked to pick their top three companies in terms of quality of sales reps, digital initiatives and patient initiatives. We set out to consolidate these results, we compared and analysed - and came back with a number of key observations.

Leading pharma companies spend over 20% of their marketing budget on digital…

...but have similar problems with optimizing the channel mix as the rest of the industry.

In 4 years’ time, pharma-owned websites grew into the top pharma channel for US oncologists

Last year, we had a look at the evolution of channel performance in the EU5 Oncology market using our 2014 cross-channel Navigator1 for Oncology & Hematology. In this article, with the latest data from our 2015 cross-channel Navigator for Oncology US (n=80), we look at how channels are evolving in the US in terms of reach and impact by comparing our most recent data (Q4 2015) and our earliest data from 2011.

Is channel preference really binary or rather 50 shades of grey…

Should you offer only digital channels to digerati HCPs and offline channels to F2F-oriented HCPs and relationship seekers?

Occasionally, we run analyses with our cross-channel Navigator1 and cross-reference them with our common-sense assumptions to see if they align, and if not, what new insights we can otherwise gather.

Heading to the new reality in healthcare: it really is all about the patient

In the past decade, practically every industry has been shocked by the arrival of new players on their scenes – players who argued that they could do it all in a different and better way. And you know what? They can.

Only one third of US-based primary care physicians satisfied with pharma’s digital offerings

Our international 2015 Cross-channel Navigator study for GPs/Primary Care has just been closed. When we delve into the data for the US market (n = 103), some interesting findings became clear.

The more Pharma exposes GPs to digital communication, the more they like it!

In Q2 2015, we released our Cross-channel Navigator 2.0 for GPs (15 markets including EU5, US, AsiaPac, Latam; 1537 respondents). For this article, we had a look at a new parameter: the extent to which doctors declare themselves satisfied with digital offerings from the pharmaceutical industry. We specifically looked at EU5 general practitioners (n = 524).

A Tale of Satisfied and Dissatisfied Pharma Managers

Across Health has been running its Multichannel Barometer since 2009, and this program has now resulted in a consolidated database of pharma managers’ views and opinions on digital marketing. In this article, we focus on the differences and similarities between satisfied and dissatisfied pharma leaders (satisfied: n=130, dissatisfied: n=314).

The Digital Divide in pharma: HCPs’ needs exceed pharma’s digital offerings, particularly in the medical space

While the digital age has been upon us for some time, pharmaceutical companies still struggle with their digital offerings towards HCPs. Wide-spread thinking throughout the industry often attributes this to the ‘traditional’ mindset of HCPs: they are thought to prefer (single-channel) offline F2F contact with a sales rep above all other channels.

EU5 oncologists increasingly welcome pharma’s digital offerings

We recently finalized our cross-channel Navigator for Oncology & Hematology (9 markets, 655 respondents). For this article, we decided to have a look at the evolution of reach and impact for a number of common traditional and digital channels vs 2011, the earliest dataset in our database.

Wired Doctors Listen to Their Patients!

Our research covers the patient when analyzing the impact of channels and stakeholders on prescribing behavior. Typically, the patient scores in the middle range: less impactful than a colleague or a medical journal, but more impactful than e.g. mass promo channels.

UK Specialists more influenced by digital pharma channels than GPs

In 2013, Across Health collected channel data for over 2600 HCPs, distributed over a number of specialties and geographies (mainly EU). Key metrics cover ‘Reach’ and ‘Impact’. All results were consolidated in a searchable database used to examine the UK communication landscape.

Digital native HCPs are largely underwhelmed by pharma’s digital offerings

Pharmaceutical marketers are increasingly focused on developing cross-channel campaigns to obtain maximum effect. Their main segmentation dimensions continue to be prescribing potential and Rx share – just like in the “old normal”. However, additional criteria may be used to get closer to the “right message, right customer, right time” ideal.